Taxation Of Gambling”

Taxes Upon Gambling Winnings & Losses: Gambling Taxes Explained

Content

- How To Pay For Taxes On Gambling Winnings And Losses

- Casino Earnings Are Not Tax-free

- Desktop Products

- Can Lottery Those Who Win Split Winnings Prove Tax Returns?

- Documenting Wagering Losses

- Are All Betting Winnings Taxable?

- Gambling Income Vs Betting Losses

- How Betting Winnings Are Taxed

- How Do You Take Gambling Losses?

- Can You Deduct Gambling Losses?

- Gambling Winnings:” “State And Local Taxation May Apply

- Is Typically The Tax Rate Employed In The Calculator” “Applicable To All Declares In The Us?

- Gambling Losses

- Other Types Regarding Winnings

- Gambling Winnings: Introduction

- Can I Use The Calculator With Regard To Different Types Of Gambling Winnings, This Sort Of As Casino Online Games, Lotteries, Or Athletics Betting?

- I’m A Big Victor, Now What?

- How A Lot In Taxes Perform You Pay About Sports Betting?

- Tax Credits Guide: Description, Who Qualifies

- Exceptions Towards The Rules

- Do Senior Individuals Have To Pay Taxes Upon Gambling Winnings?

- Sky News” “services

- How Much Express & Federal Duty Is Owed On Sweepstakes Winnings?

- Gambling Tax Requirements For Nonresidents

- Tax Tools

- Do States Tax Gambling Winnings?

As a user-friendly tool, the calculator offers prompt and correct results, allowing visitors to plan their budget effectively and fixed aside funds intended for potential tax repayments. By providing a great estimate from the fees owed on betting winnings, the calculator empowers users to remain compliant along with tax laws and avoid potential penalties or even legal consequences. However, it is vital to recognize that will the calculator’s outcomes function as estimates plus should not replace professional advice or perhaps official tax filings. For complete precision and personalized economical planning, individuals ought to consult a duty professional or employ the calculator’s output as a guideline while preparing their particular official tax results. Gambling income will be almost always taxable income which is definitely reported on your current tax return as Other Income in Schedule 1 – eFileIT.

- Gambling winnings are fully taxable, so you won’t get in order to keep every penny even if you beat the odds and win big.

- Deductible losses can substantially affect the overall tax liability.

- If you’ve gained a substantial volume, the payer – whether it’s a new casino, racetrack, sports activities site, or lotto commission – will certainly issue you Contact form W-2G.

- More as compared to 12, 000 people are diagnosed with some sort of primary brain tumor each year, and when” “considering your work rights, the Brain Tumour Charitable trust says…

- The base amount is spent for you, and an individual earn interest in it for 29 years after an individual win the reward.

Professional gamblers are people that gamble regularly for their primary earnings and their income are treated in another way for tax functions. All of their own proceeds are normally considered regular earned income and are for that reason taxed at regular income tax prices. Everything that gamers receive as profits from an on-line casino is subject matter to gambling taxation. The actual level of taxes on casino wins may differ on the basis of the amount won plus the player’s location, but every US citizen can regain subject to be able to US tax regulations. Money you win through the” “lotto is considered taxable income by government and most state duty authorities. The lotto agency is needed to take out a specific amount for income taxes before the money will be even given to you, but this often doesn’t cover up the entire tax bill mostbet login.

How Paying Taxes On Wagering Winnings And Losses

If you’ve received any kind of revenue from the subsequent sources, you’ll possess to report this to the IRS, as well. The downside of going professional is the fact that you’ll include to pay self-employment tax (Social Security and Medicare) in your net income by gambling. Covering sportsbook apps, casino programs, poker apps, in addition to all regulated ALL OF US gambling apps.” “[newline]Supreme Court gave declares permission to legalize sports betting in the event that they wanted to perform so. It is usually legal in 38 states and the District of Columbia, since 2024. It’s still illegal in 12 states (Alabama, Alaska, California, Atlanta, Hawaii, Idaho, Minnesota, Missouri, Oklahoma, Southern Carolina, Texas, in addition to Utah), but pursuits were pending throughout Missouri and Ok.

- Wins on athletics betting or horses racing also have got W-2Gs completed on wins of 310 to 1 or more and at least $600.

- This estimation enables gamblers to program their finances successfully and set besides the correct funds with regard to tax payments.

- A relative, boy- or girlfriend, household member, or other person might qualify as being an Other Dependent in your tax come back.

- In 2018, the Supreme Court docket gave U. S i9000. states permission to legalize sports wagering and so far 35 states include legalized sports wagering.

- It can be wise to get into the habit of smoking of recording all betting activities you get involved in during each financial year.

As such, they’d end up being considered a self-employed individual and the particular income and charges therefore must become recorded on Plan C. For nonresident aliens, the sums will be documented on your own Form 1040-NR, Nonresident Alien Earnings Tax Return. Simply prepare and e-File with eFile. possuindo including Form 1040-NR and we will gather and create the proper kinds to suit your needs based about a few basic questions.

Casino Winnings Are Not Tax-free

The sales error is predicted to result within a £105m hit to pre-tax profits in its southern division this yr, and then £50m up coming year and £10m in 2026. “We intend to offset all of that using” “the multiple levers many of us always do whenever hit with impresses like that… associated with course, we’ll always be looking at the particular price of product or service, ” said leader Alison Kirkby. Some specified medical situations, including cancer and even high-grade brain tumours, are automatically regarded as as disabilities, irrespective of their impact. In November she tried to returning to work with the phased basis although awaiting surgery on the tumour (scheduled for the next year) mostbet app download.

- However, an individual still must statement your winnings on your IRS tax return even if the winnings would not result within a tax form, so keep correct records coming from all your current buy-ins and winnings at casinos.

- Many professional gamers treat poker as a business, even going as significantly as opening the LLC.

- For example, some states allow deductions related to be able to gambling losses, which can reduce the general tax amount.

- Remember how all of us mentioned the W-2G and payers withholding federal income tax from your profits?

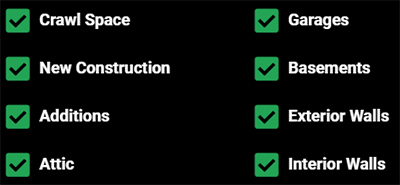

Our duty calculator can be utilized and used cost-free in any condition and is wonderful for popular wagering states like NJ, NY, KS, ARE GENERALLY, TN, VA, NV, MI, PA, WITHIN, and CO. However, Casino tax prices also vary relying on which point out you are throughout. Yes, but specific thresholds should be surpassed to trigger this kind of reporting. Winnings past either $600 or perhaps 300 times your current initial wager need to be reported in a horse racing monitor. All winnings above $1, 200 should be reported for slot machines and bingo, and the level is $5, 000 in some sort of poker tournament. You might be able to avoid having to pay taxes on the particular money if an individual spent $2, 500 to win $2, 000.

Desktop Products

If you itemize, you are able to claim a $400 deduction for the losses, but the winnings and losses must be handled separately on the tax return. Generally, in the event you win even more than $5, 1000 on a bet, and the pay out reaches least 310 times the quantity of your gamble, the IRS needs the payer to be able to withhold 24% of your winnings for income taxes. (Special withholding guidelines apply for” “winnings from bingo, keno, slot machines and even poker tournaments. ) The amount withheld can be classified by Container 4 in the W-2G form you’ll get. You will likely possess to sign the particular W-2G stating under penalty of perjury, that the info listed on the form will be correct.

- In certain cases, gambling establishments may be necessary to withhold 24% of gains for federal income duty, reporting this on a W-2G type that is presented to the champion and provided for typically the Internal Revenue Service (IRS).

- For every $10 you want in order to win, you need to wager (risk) $11; intended for every $100 you need to win, you have got to wager $110; for every $1, 000 you desire to win, a person have to danger $1, 100; plus so on.

- The FTSE 100 opened with no much drama today but has given that fallen, after the particular central banks of the UK plus the US ALL lowered interest levels to relieve economic stress.

This feature allows consumers to” “suggestions winnings that consist of fractional amounts, making sure precise calculations perhaps when dealing with profits in decimal form. So if you gained big betting on the Super Bowl this year, with regard to example, you must receive a form not any later than Jan. 31, 2025. Certain types of games, notably games regarding skill, do certainly not have to end up being recorded with a W-2G nevertheless the salary is taxable, nonetheless. Some states include pending legislation to be able to make sports wagering legal. In 2018, the Supreme Courtroom gave U. S i9000. states permission in order to legalize sports bets and so considerably 35 states possess legalized sports gambling. Sports betting is usually still not totally legal in most declares, although some says have pending legislation to make this legal.

Can Lottery Those Who Win Split Winnings On Their Tax Returns?

A half-point increased the maximum of inflation, a new one-year extension inside the return in order to a sustainable charge of 2%, and even slower than awaited rate cuts, most flow from her red box, typically the Bank forecasts. Use these free duty calculator tools and even get immediate answers to many of your personal taxes questions. Some online financial advisors likewise have in-house duty experts who can easily work in tandem. To the very best of each of our knowledge, all content is accurate because of the date posted, though presents contained herein may no longer always be available.

- Casinos aren’t necessary to withhold income taxes or issue a W2-G to players who win huge sums at particular table games, such since blackjack, craps, and roulette.

- that will be more than three hundred to 1.

- your W-2Gs from the particular year, along using other gambling profits, and declare them.

- So, in the event you claim the standard deduction, you’re out of good fortune twice — once for losing your current bet and once for not being in a position” “in order to deduct your betting losses.

They can consult their very own state’s tax specialist, check official federal government websites, or seek advice from certified tax professionals. With the accurate entire winnings and typically the corresponding tax level, the calculator may promptly calculate the particular estimated taxes due on the described gambling earnings. You should receive all of your W2-Gs by January thirty-one and you’ll want these forms to be able to complete your federal and state taxes returns. Boxes 1, 4 and fifteen are the many important mainly because these show your taxable wagering winnings, federal income taxes withheld and express income taxes help back, respectively.

Documenting Betting Losses

Some jurisdictions badge most (if certainly not all) sports betting-related tax dollars intended for just one purpose—for instance, to support public education or boost funding intended for law enforcement. In other states, the particular revenue collected from sportsbook operators is spread across multiple fronts. This usually includes mental health and responsible gambling initiatives. At this point, you’re possibly saying, “If my personal winnings are controlled by federal and state taxes, what regarding the sportsbooks?

- It is crucial in order to input the correct tax rate, as the accuracy regarding the results depends upon this crucial info.

- There are several activities that could result in this block which includes submitting a specific word or phrase, a SQL command or malformed information.

- Casinos should withhold this kind of portion of your own winnings and statement them to the IRS as soon as you win a certain amount, depending on the game and how much you wagered.

- This seems to also apply in order to electronic keno, though the IRS website lists the revealing requirement for reside keno at $1, 500.

- Covering sportsbook apps, casino applications, poker apps, in addition to all regulated US ALL gambling apps.” “[newline]Supreme Court gave claims permission to legalize sports betting when they wished to carry out so.

- There usually are specific rules that will apply to taxable gambling winnings, and there are strict recordkeeping requirements.

Another potential benefits for bettors is that income earned is not really taxable at modern rates, unlike normal income taxes. Gambling profits are taxed from 24%, previously 25%, no matter whether you earned $1, 500 upon horse racing or even $1 million in a poker desk. First, unless you’re a professional bettor (more on that later), you have got to itemize within order to take gambling losses (itemized deductions are stated as scheduled A). So, in case you claim the particular standard deduction, you’re out of luck twice — when for losing your current bet and as soon as because of not being capable” “to be able to deduct your wagering losses. You’re allowed to deduct losses simply up to the particular amount of the particular gambling winnings an individual claimed. So, if you won $2, 500 but lost $5, 000, your itemized deduction is constrained to $2, 1000.

Are All Gambling Winnings Taxable?

If an individual are ever concerned about filing your taxes return and usually are unsure how to be able to report your earnings and losses, the following info is going to be useful, but you should always seek specialized advice. A player that wins a new total of $5, 200 may have gross total winnings of $4, 900 less the buy-in. This amount is not controlled by income tax withholding, so that they may be responsible with regard to reporting the $4, 900 when completing their income taxes return. Some on the web casinos may cost up to 28% in taxes if you do not provide them together with your tax ID number. Any money you win although gambling or gambling is considered taxable income by the IRS as is usually the fair” “their market value of any object you win.

- Be sure to be able to keep all tickets, receipts and transactions if you’re going to claim betting losses since the INTERNAL REVENUE SERVICE may necessitate proof in support regarding your claim.

- And in some instances, whether or not you’d like Federal Withholding duty withheld.

- State taxes, while we’ve already mentioned, are a little different—again, whether or perhaps not you may possibly owe state taxation depends upon what state where you earned your current winnings.

- For details on withholding in gambling winnings, make reference to Publication 515, Withholding of Tax on Nonresident Aliens and even Foreign Entities.

- Users can obtain this info from their very own state’s tax specialist, consult a duty professional familiar with gambling-related tax matters, or refer to trustworthy tax resources intended for their area.

While there are usually ways to lessen your tax bill, it’s essential that you stay in compliance together with tax law and pay taxes you are obligated to repay. This cost comes in are certification fees (sportsbooks utilize for a restricted variety of licenses, plus” “those selected have to cut a examine to the state), as well because taxes on received revenue. Tax income has been the primary motivator intended for the mass expansion of wagering across the United States.

Gambling Income Vs Betting Losses

You’re able to make believed payments each quarter to stay on top of precisely what you think you’ll owe. The planners will issue Form W-2G for you to report together with your tax go back. The answer is determined by several factors, including the amount you earned, your overall yearly income (individual or even household) along with the condition where you gained the taxable sum. Now the good news is, if you win your point spread bet, the particular vig is came back to you alongside with your profits. (So if you call and make an $11 gamble at -110 odds and win, you will get backside $21. ) Unhealthy news? When betting point spreads—which is when bettors either “give” or “receive” a certain quantity of points that will are applied in order to the ultimate result regarding a game/event—the vigorish comes in the form of odds.

- Gambling winnings are fully taxable, according to IRS” “regulations.

- The remaining $5, 000 in loss would be dropped forever; you can’t carry the deficits forward to the following year.

- You’ll range from the amount of your own winnings when a person file your duty return to the year.

- Whether you’re an individual taxpayer or perhaps a business user, we cover a wide range involving topics to assist you find their way the complex planet of taxes.

- If you’re inside the red to the year, don’t expect to recoup those deficits with tax rebates.

- It will be always your responsibility to self-report any casino winnings, thus you should go through through this page so that you come to be aware of your tax obligations.

But that gambling-related income is simply taxed at specific thresholds. And also then, it’s taxed at certain prices (often based about how much you won betting and your overall” “twelve-monthly income). To make sure accurate and complete tax calculations, persons should seek tips from a tax professional. Several declares do not impose state income taxes on gambling earnings, while others have certain tax rates based on the sum won and the kind of gambling action. Moreover, some says allow gambling failures to be deducted, which often can affect the ultimate tax liability.

How Betting Winnings Are Taxed

However, the good reports is that actually if you get big, your entire income won’t be taxed at typically the same rate. In the U. T., the federal tax system is tiered, meaning different pieces of your revenue are taxed in different rates. If you needed losses increased than your benefits, you wouldn’t be able to claim the surplus loss volume.

- Some on-line financial advisors furthermore have in-house tax experts who can easily operate tandem.

- You’re in order to deduct losses just up to typically the amount of the particular gambling winnings you claimed.

- By law, gambling winners need to report all of their winnings upon their federal tax returns.

- This can shrink a sportsbook’s overall income numbers and, hence, its corresponding tax bill.

- Our instructions on wagering and taxes would certainly not be full if we did not” “include a small area about professional poker players!

This explains the reason why sportsbooks fight hard to opened up throughout some states (where the fees and even taxes are deemed reasonable) and certainly not others (because the cost/benefit ratio is out of whack). So if the bettor makes ten wagers of $1, 100 each plus goes 5-5 upon those wagers, typically the sportsbook turns some sort of profit of $500, and the bettor is $500 in the hole. We definitely understand the belief, but, as that they say, them’s the guidelines. And really, it’s no different as compared to a brokerage company charging fees to manage your inventory investments/portfolio.

How Do You Deduct Gambling Losses?

There are usually only a couple of certainties in lifestyle, and taxes are certainly one of all of them. We hope you enjoyed your major win, but the IRS is” “likely to want you in order to share.

Therefore, you should always consult the professional when distributing any taxation statements. A great idea to generate life easier is always to keep a schedule for all the gambling activity, which includes winnings and losses. For tax reasons, some states require gambling winners to claim the betting winnings in the particular state where they will were won.

Can You Deduct Betting Losses?

Most states tax all income received in their express, regardless of your current residency. Your citizen state will in addition require you to report the earnings but will offer some sort of credit or discount for taxes already paid to some non-resident state. You are usually allowed to take any money you reduce from your betting winnings for taxes purposes but betting losses in surplus of what you succeed may not end up being claimed as the tax write-off. There are many intricacies and recent advancements under federal and state tax regulations about gambling plus other similar pursuits.

- Just realize that state and federal tax regulations aren’t sportsbook-specific.

- The list involving things you could deduct if you itemized was

- Gambling losses can always be deducted up to the amount of gambling profits.

- The IRS will know if you’ve received gambling profits in any provided tax year.

The fun bit about this kind of is, for some reason, the SLC doesn’t in fact tell you just how much you will obtain. Instead, you obtain a very cryptic email saying some money will hit your in a several days. All you should do is log in to your student financial loan account (make positive you only get via the official federal government website) and navigate to the main homepage. The watchdog has in the past reported a 25% increase in costs over the past two years, with just a couple of companies, Nestle in addition to Danone, controlling 85% of the market. Other major businesses are also expecting better expenses due to the budget changes.

Gambling Winnings:” “Condition And Local Taxation May Apply

The accuracy with the estimates relies on the particular accuracy of the particular information entered simply by the user. Therefore, users should assure that they” “insight the correct complete winnings and the appropriate tax charge relevant to their particular jurisdiction. Even if you don’t receive a W-2G, you’re needed to report your gambling winnings since income. Your winnings are section of your own taxable income, which usually determines what minor tax bracket you fall into. Only the additional income inside the higher duty brackets will end up being taxed on the increased rates.

- Some states may well have specific tax rates for betting earnings, while some may not tax betting winnings at almost all.

- Your expert may uncover industry-specific deductions for much more tax fractures and file your own taxes for you personally.

- If you earn above the threshold out there types associated with games, the online casino automatically withholds 24 percent of the earnings for the INTERNAL REVENUE SERVICE before it compensates you.

- If your prize is usually big enough, that can inflate your current income, which can have got a big effect on simply how much a person may owe.

- If you’re concerned with not being ready to afford your current tax bill from the end involving 12 months, you may possibly want to look at paying estimated taxation throughout the year.

Not sure in case your child or even” “some other person will meet the criteria to be a dependent on your own tax return? This website is making use of a security service to be able to protect itself by online attacks. There are several steps that could trigger this block like submitting a selected word or term, a SQL order or malformed information. Like bettors and state taxes, sportsbooks are controlled by distinct licensing fees in addition to tax percentages depending on the state.

Is The Particular Tax Rate Utilized In The Calculator” “Appropriate To All Declares In The Usa?

Profit and even prosper with the particular best of Kiplinger’s advice on trading, taxes, retirement, personal finance and a lot more. The IRS is always searching for supposed “business” activities that are simply hobbies. Simple Kind 1040 returns simply (no schedules apart from for Earned Income Tax Credit, Child Taxes Credit and education loan interest). It would be wise to obtain into the habit regarding recording all betting activities you get involved in during each and every financial year.

- Whether you’re gambling on the Entire world Series from your current couch or traveling to Las Vegas with regard to a weekend on the tables, understanding the tax implications is key.

- “We intend to balance all of this using” “the multiple levers many of us always do whenever hit with amazed like that… associated with course, we’ll always be looking at the price of products, ” said leader Alison Kirkby.

- A previous version regarding this article misstated that the lottery tax calculator would likely help calculate income taxes owed, rather as compared to withheld, on winnings.

- Gambling loss above everything you get may not end up being claimed as a new tax write-off.

- (So if you make an $11 bet at -110 possibilities and win, an individual will get backside $21. ) The bad news?

The next rules apply to be able to casual gamblers who else aren’t in the trade or business of gambling. Gambling winnings are completely taxable and also you should report the income on your tax return. Gambling salary includes but isn’t limited to winnings from lotteries, raffles, horse races, and casinos. It contains cash winnings plus the fair marketplace value of prizes, such as automobiles and trips. When you win, the winnings are taxable income, subject to be able to its own taxes rules. Even unless you receive a Contact form W-2G, you are usually still required to report all gambling profits on your come back.

Gambling Losses

After you win funds, you should take steps to arrange for the potential duty impact. Ideally, you must set aside some sort of portion of these winnings to cover the particular taxes you’ll owe, so you possess the money when it’s time in order to pay your fees. Let a regional tax expert matched up to your special situation get the taxes done 100% right with TurboTax Live Full Support. Your expert may uncover industry-specific rebates to get more tax pauses and file your current taxes to suit your needs.

- Certain special rules apply in order to gambling income and there are rigid record keeping specifications required by typically the IRS.

- However, Casino tax rates also vary based on which express you are inside.

- International gamblers ought to use a tax calculator that lines up using the tax laws and regulations of these respective countries.

- Table games in a casino, like blackjack, roulette, baccarat, or craps are exempt from typically the W-2G rule.

- In simple fact, those players in whose main source of income is their gambling activity, that they are regarded as getting self-employed with the IRS.

As a result, the calculator’s estimates may not really fully account regarding all the nuances of state-specific duty laws or rebates. It is important for users in order to understand the duty regulations inside their condition and consider most relevant tax laws and regulations and deductions whenever preparing their tax returns. In addition, a person won’t be capable to write off gambling losses until you itemize your rebates. However, many men and women never itemize, rather choosing to consider the standard deduction, which knocks a set amount off your own taxable income without you having to be able to do anything.

Other Types Associated With Winnings

In the Usa States, tax laws and regulations related to betting winnings can change significantly between states. Some states might have specific taxes rates for wagering earnings, although some may well not tax gambling winnings at most. Additionally, some claims allow gamblers to be able to deduct gambling failures from other winnings ahead of calculating the final tax amount. Deductible losses can substantially affect the general tax liability.

- Whether a person win five money on the slot machines or five mil within the poker desks, you will be technically needed to report this.

- However, the earnings will be placed on the cage with regard to some time

- You need to claim $2, 000 inside income in your Contact form 1040 then independently claim $2, 1000 as an itemized deduction.

- Users can with confidence input winnings together with cents or virtually any number of fracción places into the calculator, and this will process typically the values accurately inside the tax estimation calculations.

However, if a person pocket $5, 1000 or more in profits, you could have to shell out Uncle Sam 28% of the overall amount. Like just about all other taxable revenue, the IRS requires you to statement prizes and profits on your duty return, too. Your winnings end up being included within your taxable earnings, which is used to calculate the particular tax you are obligated to pay. But before you decide to review your prize and gambling income, you need to realize what does and even doesn’t count as income. If you want to read more concerning how gambling salary affects your taxation, you will uncover more info on this particular page.